Global cyber insurance pricing increases 32% as insurers grapple with the changing face of cyber risk

Published

Read time

“Cyber Insurance: A Hard Reset”.

Howden, the international insurance broker, has today released a new report on the cyber risk landscape, titled “Cyber Insurance: A Hard Reset”.

The report looks at how three key factors are driving the cyber insurance market today, namely rampant ransomware attacks, higher rates and shifting regulation – the three Rs.

- The frequency and severity of ransomware incidents have risen considerably over the last year, as cyber criminals deploy new tactics and techniques to achieve one simple goal: to make money.

- Proprietary research conducted by Howden shows how superior mitigation and response measures can support shareholder value and minimise reputational risks

Labelled the ‘digital pandemic’, the report shows that ransomware is now the predominant cyber threat confronting businesses of all sizes. Industry data reveal that the number of ransomware attacks worldwide increased by 170% (4Q20 compared to 1Q19). The severity of incidents has been even more impactful: for U.S. companies that decided to pay a ransom in 1Q21, the average payment was up by more than 400% compared to FY2019. The average cost of ransomware remediation globally has also increased in 2021, rising to USD 1.85 million from USD 700,000 in 2020. Average remediation costs across a number of major markets, including the United States, now exceed USD 2 million.

The proliferation of accessible and relatively low cost, ransomware kits, or ransomware-as-a-service (RaaS), combined with a new attack method involving both data encryption and the publication of stolen data, otherwise known as double extortion, has seen the frequency and severity of attacks soar.

Figure 1: Global cyber insurance pricing index

(Source: HX Nova Portal)

All of these factors have led to what is the largest medium-term rate increase across the entire insurance market as carriers react swiftly to get ahead of spiralling loss costs. Howden’s research finds that global cyber insurance pricing has increased by an average of 32% year-on-year in June 2021 (see Figure 1) on the back of a 50% rise since data tracking began. Insurers are also demanding more from businesses’ cyber resilience and are only willing to deploy capacity if they are satisfied by the strength of companies’ risk management frameworks.

Shay Simkin, Global Head of Cyber, Howden, commented: “Cyber risk has undergone multiple episodes of change and development in its relatively short history, but nothing quite so impactful and fundamental as the events over the last year. COVID-19, and all of its attendant effects on technology adoption and cyber security, combined with independent or connected changes to the loss environment, has added a big dose of complexity into an already complicated risk landscape.”

“The cyber insurance market is currently driven by a demand and supply imbalance which shows no sign of relenting any time soon. Claims are up, capacity is down and underwriting profitability is, at best, under pressure. The impact on insurance buyers is stark; the importance of being prepared for a cyber attack has never been clearer. With insurers now demanding markedly higher cyber security standards before deploying capacity, businesses need analytical solutions designed specifically for them, combined with focused, expert intermediation to help them secure the coverage that meets their needs.”

Other key findings include:

The growth of cyber insurance

Cyber has until recently been a lucrative business for (re)insurers, and the market has grown substantially in the last five years. Gross written premium (GWP) has more than doubled since 2016 (growing at a CAGR of 22%), significantly outpacing the broader P&C commercial sector. A similar rate of expansion is predicted for the global cyber market over the next few years (at CAGR of 23%), which would see GWP approach USD 20 billion by 2025.

With cyber risk growing in perception and reality, strong momentum is building across the cyber insurance market. No other business line has such a fluid risk landscape on the one hand, but such growth potential on the other. These tensions are currently playing out in the market, with demand for dedicated cyber cover increasing at a time when market supply is dwindling.

Nevertheless, the degree of progression to date points to a cyber market that is adapting and responding to mega-trends that are bringing technology and digitalisation to the fore. The insurance sector is innovating and developing solutions for the changing needs of clients whilst paying claims quickly and consistently in the event of a loss.

The COVID-19 impact

COVID-19 has amplified the risks associated with cyber and revealed pre-existing vulnerabilities to an interdependent and interconnected world that is heavily reliant on digital technologies. Whilst companies are investing heavily in data and cloud security to accommodate the permanent changes brought about by lockdown, such as remote working and accelerated digitalisation, bad actors are often one step ahead and will continue to target weaknesses in order to cause disruption, steal data and make money.

Data shows how bad actors have exploited interest in and concerns around COVID-19 to entice users to click on malicious links or attachments. Delays in breach discovery and response due to fewer on-premises employees has also exacerbated the situation.

The value of preparedness

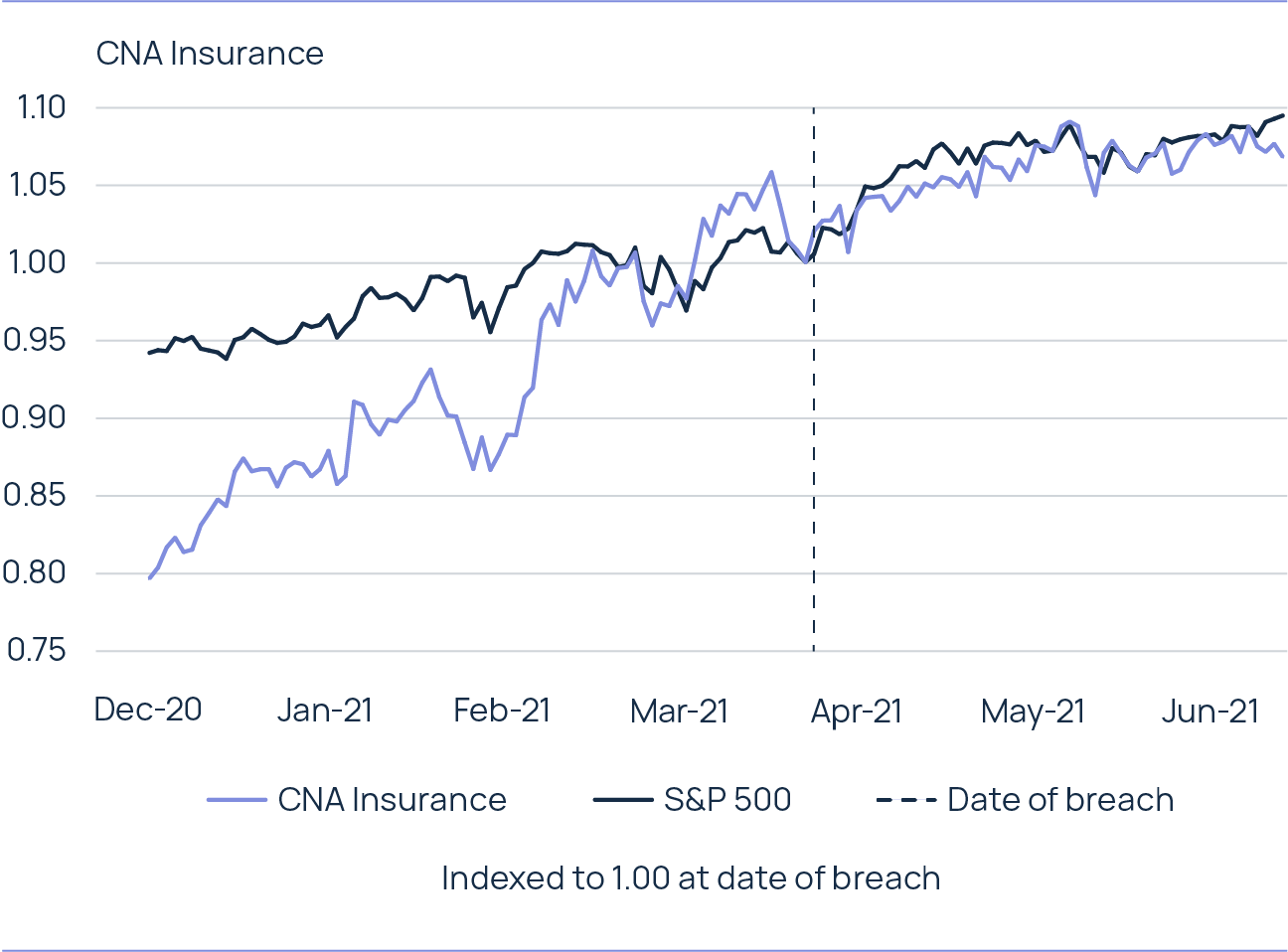

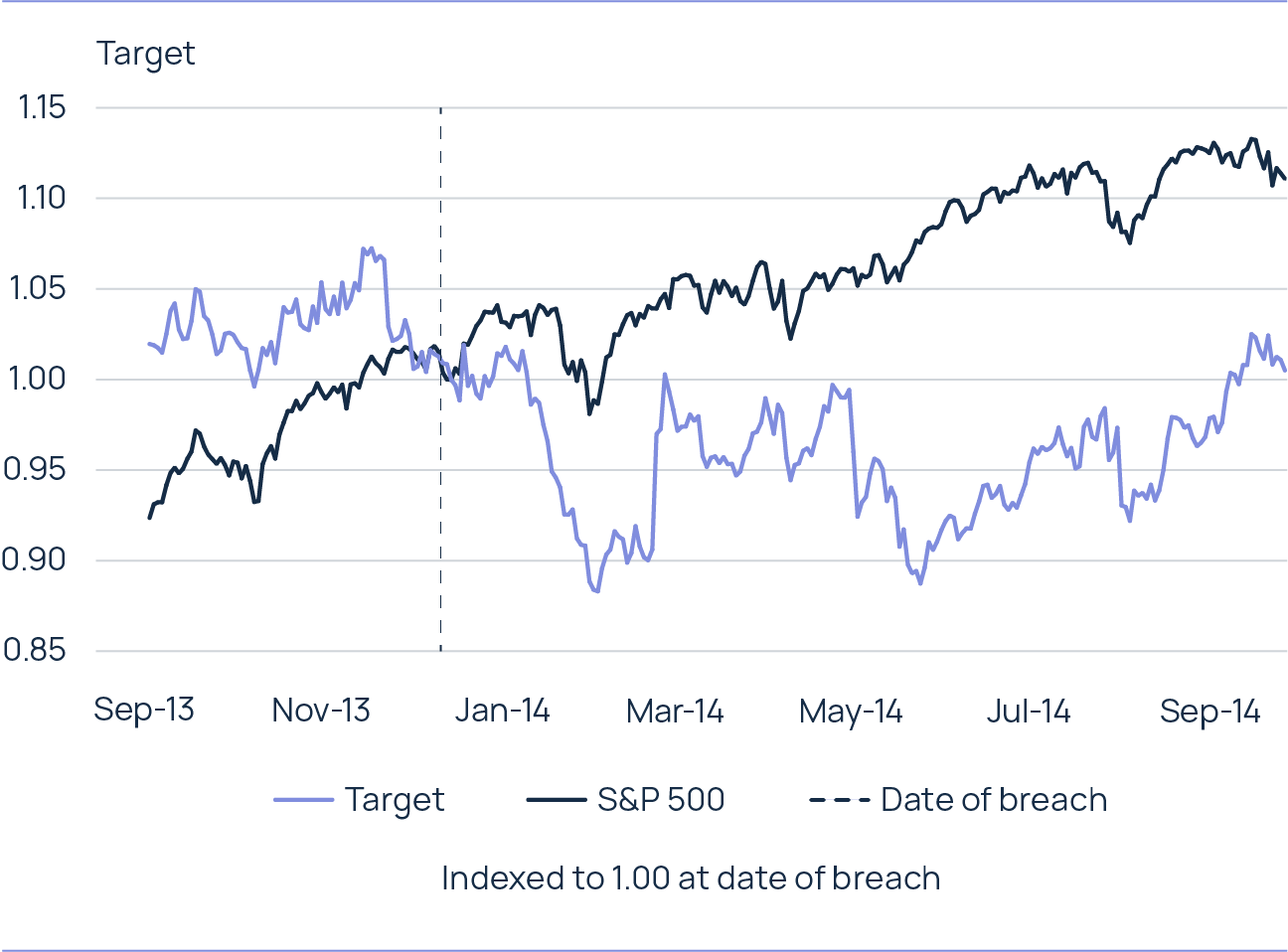

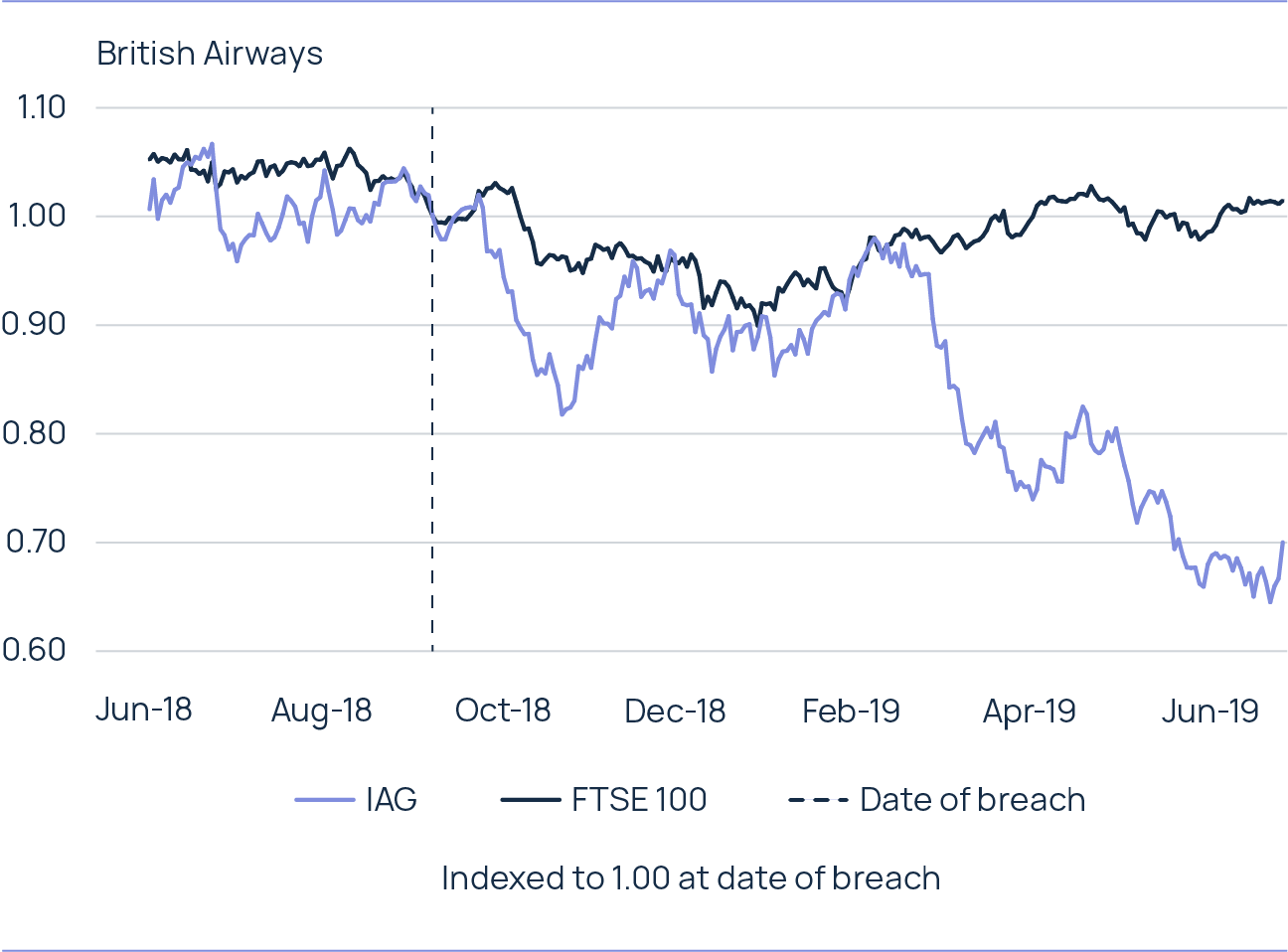

The best solution for any cyber incident is preparation. Proprietary research conducted by Howden shows how superior mitigation and response measures can support shareholder value and minimise reputational risks in the event of an attack (see Figure 2). Unprepared companies, on the other hand, typically suffer disproportionate impacts that can lead to regulatory activity or litigation (see Figure 3).

The clear takeaways to emerge from our study are simple: planning is crucial and investment in cyber security and incident response is money well spent. Developing a tested, comprehensive response plan and having a robust cyber insurance programme in place can help contain the impact and control external risks around customer and shareholder perceptions, even in this highly dynamic loss environment.

Figure 2: Strong performance post-cyber breach

(Source: HX Analytics, Bloomberg)

Figure 3: Substandard performance post-cyber breach

(Source: HX Analytics, Bloomberg)

Securing cyber cover

Cyber has well and truly ‘emerged’ to become one of the pre-eminent risks facing businesses today. But whilst the trajectory of incidents and insurance costs may at times seem uncontrollable, companies can still make a difference by strengthening their cyber security.

Preparedness is a crucial component of companies’ cyber resilience. It involves building and testing a robust plan for the eventuality of an attack, requiring close collaboration across organisations, including board level stakeholders and key IT and security leaders.

Speed is of the essence following a cyber attack, and having these protocols in place will expedite companies’ responses to any potential attack and help limit the damage and costs. This is reinforced by industry data that show breached companies with a tested incident response team paid almost 40% less on average in 2020 than those without.

But even the best prepared companies cannot eliminate the risk of a successful attack entirely, and here specialist advice is available to help firms mitigate their risks and recover from any incident. For the benefit of clients, pre-eminent cyber experts have contributed to this report to offer insights into what companies need to do to achieve cyber resilience.